Some Known Details About Real Estate Reno Nv

Things about Real Estate Reno Nv

Table of Contents3 Easy Facts About Real Estate Reno Nv DescribedAn Unbiased View of Real Estate Reno NvThe 10-Minute Rule for Real Estate Reno NvThe Best Guide To Real Estate Reno NvNot known Details About Real Estate Reno Nv What Does Real Estate Reno Nv Mean?

The advantages of buying realty are numerous (Real Estate Reno NV). With appropriate properties, financiers can take pleasure in predictable capital, excellent returns, tax benefits, and diversificationand it's feasible to leverage real estate to develop riches. Believing concerning spending in realty? Right here's what you need to find out about property advantages and why genuine estate is considered an excellent investment.

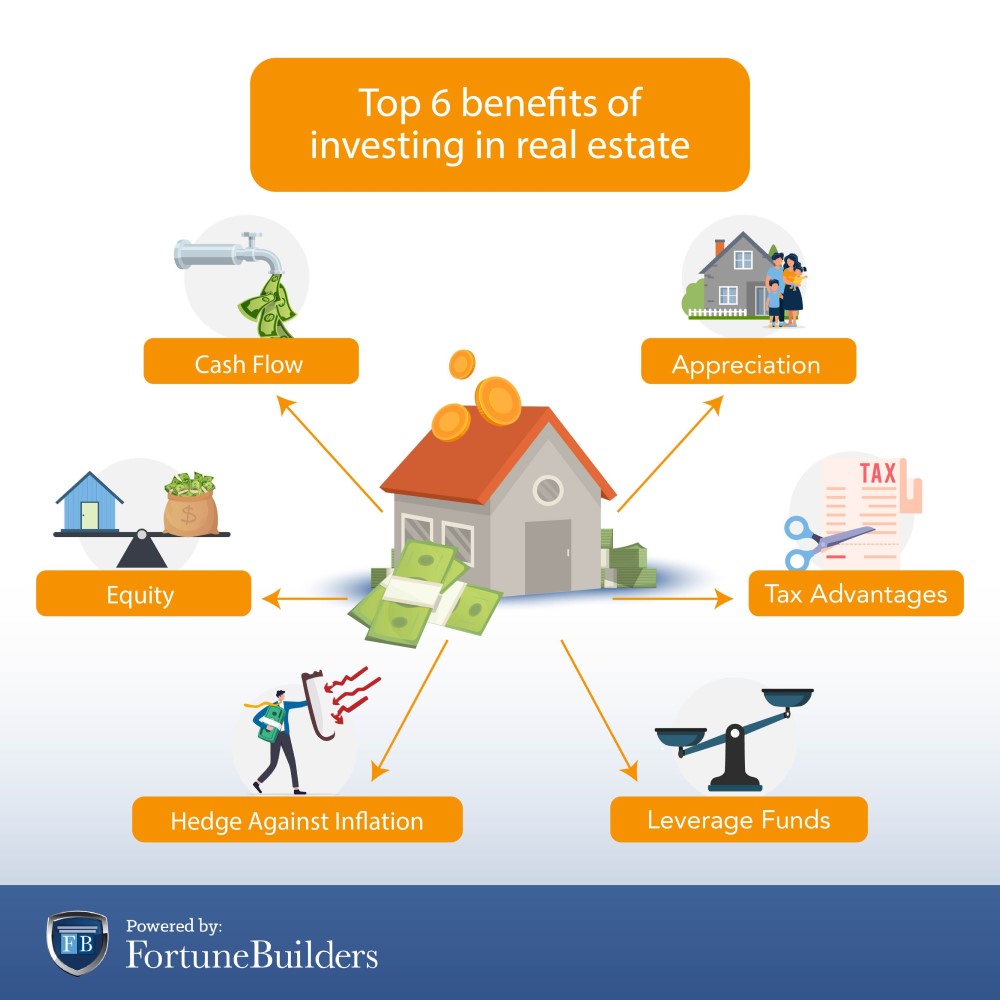

The benefits of investing in real estate consist of passive earnings, secure cash flow, tax benefits, diversification, and utilize. Actual estate financial investment depends on (REITs) provide a means to invest in real estate without having to possess, run, or money residential or commercial properties.

Genuine estate worths have a tendency to raise over time, and with a great financial investment, you can transform a profit when it's time to market. As you pay down a property mortgage, you develop equityan asset that's component of your web well worth. And as you build equity, you have the take advantage of to buy even more properties and boost cash money circulation and wealth also extra.

Realty has a lowand sometimes negativecorrelation with various other significant possession courses. This suggests the enhancement of property to a profile of varied assets can decrease portfolio volatility and give a greater return per device of threat. Leverage is making use of different financial tools or obtained capital (e.

Facts About Real Estate Reno Nv Uncovered

As economic situations broaden, the need for real estate drives leas greater. This, subsequently, converts right into greater funding worths. Genuine estate has a tendency to keep the buying power of resources by passing some of the inflationary stress on to renters and by integrating some of the inflationary stress in the type of funding appreciation.

There are a number of manner ins which having genuine estate can secure against inflation. First, home values might rise greater than the price of inflation, causing funding gains. Second, rents on financial investment homes can enhance to stay on par with inflation. Finally, residential or commercial properties funded with a fixed-rate lending will see the relative quantity of the regular monthly home loan repayments tip over time-- for example $1,000 a month as a fixed settlement will come to be much less burdensome as inflation erodes the purchasing power of that $1,000.

Nevertheless, one can make money from offering their home at a rate above they spent for it. And, if this does occur, you may be responsible to pay taxes on those gains. Regardless of all the benefits of spending in realty, there are disadvantages. One of the major ones is the absence of liquidity (or the family member trouble in transforming an have a peek at this site asset right into cash and cash money right into a property).

Rumored Buzz on Real Estate Reno Nv

Among the simplest and most usual methods is simply buying a home to rent out to others. So why purchase realty? After all, it requires a lot more job than merely clicking a couple of switches to invest in a common fund or supply. The fact is, there are many realty benefits that make it such a prominent choice for skilled investors.

Equity is the worth you have in a building. Over time, routine payments will eventually leave you possessing a property cost-free and clear.

Not known Facts About Real Estate Reno Nv

Any person that's gone shopping or filled their storage tank lately understands exactly how inflation can destroy the power of hard-earned money. Among the most underrated property benefits is that, unlike several typical financial investments, genuine estate value often tends to go up, also during times of significant rising cost of living. Like other vital possessions, realty usually retains worth and can therefore function as an excellent location to invest while higher prices consume away the gains of different other investments you might have.

Recognition describes money made when the overall value of a property climbs between the moment you acquire it and the moment you offer it. For genuine estate, this can suggest significant gains because of the normally high rates of the assets. It's essential Home Page to bear in mind admiration is a single point and just supplies money when you offer, not along the way.

As pointed out earlier, cash circulation is the cash that begins a monthly or yearly basis as an outcome of having the residential property. Normally, this is what's left over after paying all the essential costs like home mortgage repayments, repair work, taxes, and insurance. Some residential or commercial properties might have a considerable cash circulation, while others may have little or none.

The Ultimate Guide To Real Estate Reno Nv

New capitalists may not absolutely recognize the power of leverage, however those who do unlock the potential for significant gains on their financial investments. Typically talking, utilize in investing comes when you can possess or manage a larger quantity of assets than you could or else pay for, through making use of credit.